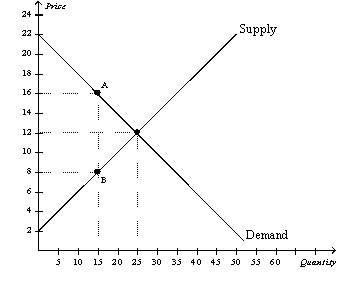

Figure 8-7

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-7.As a result of the tax,consumer surplus decreases by

Definitions:

Activity-based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing a more accurate product cost.

Overhead Cost Allocation

The process of distributing indirect costs to various cost objects like products, projects, or departments.

Activity-based Costing

A method in costing that allocates overhead and indirect costs to specific activities, providing a more accurate representation of the cost to produce a product or service.

ABC Costing

Activity-based costing; a method of allocating overhead and direct costs to specific products or activities based on actual consumption.

Q20: Suppose that a university charges students a

Q119: Other things equal,the deadweight loss of a

Q135: If the demand for leather decreases,producer surplus

Q183: Refer to Figure 9-2.As a result of

Q198: A tariff on a product<br>A) is a

Q273: If a country is an exporter of

Q285: If Darby values a soccer ball at

Q341: Economists use the government's tax revenue to

Q372: A tax placed on a good<br>A) causes

Q418: Assume the price of gasoline is $2.40