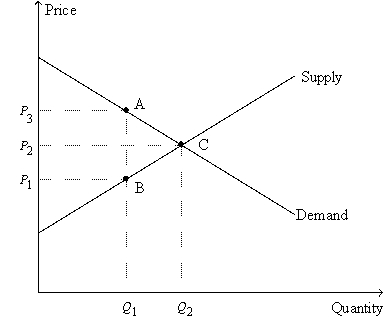

Figure 8-11

-Refer to Figure 8-11.Suppose Q₁ = 4; Q₂ = 7; P₁ = $6; P₂ = $8; and P₃ = $10.Then the deadweight loss of the tax is

Definitions:

Section 1231

A tax term relating to the classification of property that includes depreciable property and real property (e.g., buildings and equipment) used in a trade or business and held for more than one year. gains from the sale of Section 1231 property can be taxed at more favorable capital gains rates rather than ordinary income rates.

Ordinary Loss

A loss resulting from regular business operations that is fully deductible against ordinary income on a taxpayer's tax return.

Sole Proprietor

An individual who owns and operates a business alone, bearing sole responsibility for its operations and liabilities.

Short-Term Capital Losses

Financial losses realized from the sale of an asset held for a year or less, which can be used to offset capital gains and reduce taxable income.

Q59: If a market is allowed to move

Q82: Taxes affect market participants by increasing the

Q85: Suppose Ashley needs a dog sitter so

Q126: Assume,for Singapore,that the domestic price of soybeans

Q139: Refer to Figure 8-2.The amount of deadweight

Q251: Refer to Figure 9-1.When trade in wool

Q261: Refer to Figure 8-11.Suppose Q₁ = 4;

Q318: Refer to Figure 8-10.Suppose the government imposes

Q378: Refer to Figure 7-14.Total surplus amounts to

Q397: Refer to Figure 9-5.If this country allows