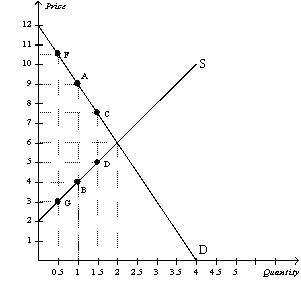

Figure 8-17

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-17.If the government changed the per-unit tax from $5.00 to $7.50,then the price paid by buyers would be $10.50,the price received by sellers would be $3,and the quantity sold in the market would be 0.5 units.Compared to the original tax rate,this higher tax rate would

Definitions:

Experimental Outcome

The result observed from conducting an experiment, which can be used to test hypotheses and theories.

Perfect Information

A situation in decision theory and economics where all participants have full and identical information about the elements of the game or economic situation.

Decision Tree

A graphical representation of possible solutions to a decision based on certain conditions, used in decision analysis to help identify a strategy most likely to reach a goal.

States Of Nature

Different outcomes or scenarios that can occur in decision-making situations, often uncertain and beyond the control of the decision maker.

Q4: Refer to Figure 8-17.The original tax can

Q99: Refer to Figure 7-15.At the equilibrium price,producer

Q150: Economists disagree on whether labor taxes have

Q158: Refer to Figure 7-18.Assume demand increases and

Q160: In principle,trade can make a nation better

Q189: Refer to Figure 8-9.The producer surplus without

Q217: Refer to Figure 8-9.The per-unit burden of

Q248: Refer to Figure 7-20.At equilibrium,consumer surplus is

Q267: Let P represent price; let Qˢ represent

Q272: Consumer surplus measures the benefit to buyers