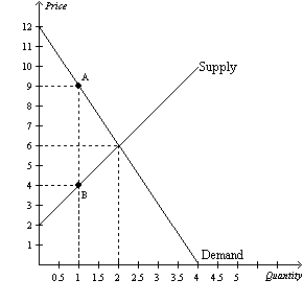

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.The per-unit burden of the tax on buyers is

Definitions:

Product Market

The platform where end products or services are made available to individuals, companies, and the general public.

Households

Individuals or groups of people living together as a single unit, making economic decisions and consuming goods and services.

Factor Market

A marketplace for the services of a factor of production (e.g., labor, land, capital), where these services are bought and sold.

Firms

Business organizations or entities engaged in commercial, industrial, or professional activities.

Q45: Refer to Figure 7-19.If the price were

Q136: A supply curve can be used to

Q137: The Laffer curve relates<br>A) the tax rate

Q181: Refer to Figure 7-6.What is the consumer

Q241: Refer to Figure 8-4.The price that sellers

Q259: If the price of oak lumber increases,what

Q276: Refer to Figure 8-3.The loss in consumer

Q326: Andre walks Julia's dog once a day

Q354: Taxes on labor tend to increase the

Q358: A decrease in the size of a