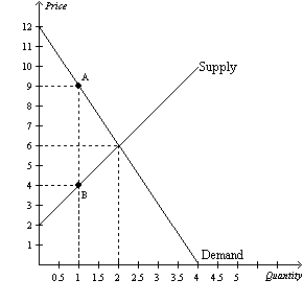

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.The per-unit burden of the tax on sellers is

Definitions:

Straight-Line

A method of calculating depreciation of an asset which assumes the asset will lose an equal amount of value each year over its useful life.

Discount Rate

The interest rate used to discount future cash flows to their present value.

Tax Bracket

A range of incomes taxed at a specific rate; tax brackets result in a progressive tax system, where taxation progressively increases as income grows.

Forecast Error

The difference between the expected or predicted values and what actually occurs, usually in the context of economic or financial forecasts.

Q109: Refer to Figure 8-11.Suppose Q₁ = 4;

Q149: As the tax on a good increases

Q158: In the market for widgets,the supply curve

Q170: Refer to Figure 7-13.If the price of

Q232: If a market is in equilibrium,then it

Q268: Refer to Figure 7-9.If the supply curve

Q286: Which of the following events is consistent

Q303: If the size of a tax triples,the

Q312: Refer to Figure 7-19.The efficient price-quantity combination

Q326: Refer to Figure 9-5.Bearing in mind that