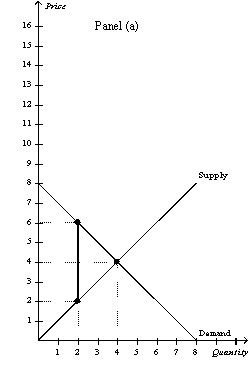

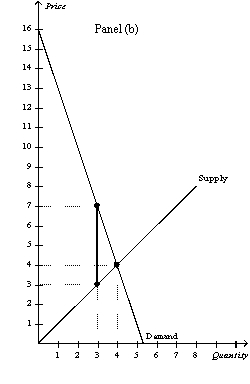

Figure 8-13

-Refer to Figure 8-13.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (b) ,Panel (a) illustrates which of the following statements?

Definitions:

Yield to Maturity

The total return anticipated on a bond if the bond is held until it matures, including all interest payments and the return of principal.

Treasury Securities

Reiteration of U.S. Treasuries, but emphasizing these are safe, low-risk investment products backed by the full faith and credit of the U.S. government, including Treasury bonds, notes, and bills.

Bond Equivalent Yield

Bond yield calculated on an annual percentage rate method. Differs from effective annual yield.

Quoted Bid Price

The highest price a buyer is willing to pay for a security or commodity at a given moment.

Q2: When,in our analysis of the gains and

Q78: Which of the following is not correct?<br>A)

Q105: As the price elasticities of supply and

Q113: Refer to Figure 8-1.Suppose the government imposes

Q183: Connie can clean windows in large office

Q192: The nation of Aquilonia has decided to

Q217: When a country allows international trade and

Q265: Taxes on labor encourage which of the

Q304: Refer to Figure 9-17.With trade and a

Q353: If the tax on a good is