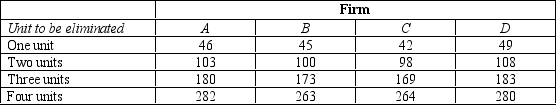

Table 10-6

The following table shows the total costs for each of four firms (A, B, C, and D) to eliminate units of pollution from their production processes. For example, for Firm A to eliminate one unit of pollution, it would cost $46, and for Firm A to eliminate two units of pollution, it would cost a total of $103.

-Refer to Table 10-6.Suppose the government wanted to reduce pollution from 16 units to exactly 8 units.Which of the following fees per unit of pollution would achieve that goal?

Definitions:

Tax Deductible

Expenses or payments that can be subtracted from gross income to reduce the amount of income subject to tax.

Bonds

Long-term securities issued by corporations, municipalities, or governments to raise funds, paying interest to holders.

Call Option

A financial contract that gives the holder the right, but not the obligation, to buy a stock, bond, commodity, or other asset at a specified price within a specified time period.

Callable Bonds

Bonds that give the issuer the right but not the obligation to redeem the bonds before their maturity date, usually at a predefined call price.

Q23: If Freedonia changes its laws to allow

Q107: In many cases the Coase theorem does

Q120: Both public goods and common resources are<br>A)

Q133: Most economists prefer corrective taxes to regulation

Q150: A lighthouse might be considered a private

Q190: In a December 2007 New York Times

Q274: Which of the following is an example

Q303: Tradable pollution permits<br>A) are widely viewed as

Q391: Suppose that electricity producers create a negative

Q392: The Coase theorem suggests that private markets