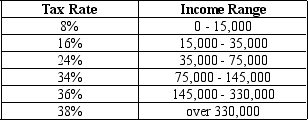

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Noah has taxable income of $43,000,his marginal tax rate is

Definitions:

Industrial Market

The market for goods and services that are purchased for use in the production of other products or for resale within industries and businesses.

Mining Companies

Businesses involved in the extraction of minerals, metals, and other geological materials from the earth, which are then used in a variety of industries and products.

Legal Services

Professional services provided by lawyers or legal practitioners related to the law.

Industrial Firm

An organization that produces goods through the processing of raw materials, manufacturing of products, and (in most cases) the sale of these products to traders, other industries, and end consumers.

Q38: For state and local governments,sales taxes and

Q73: A textbook is a<br>A) private good and

Q87: Revenues from social insurance taxes are earmarked

Q117: Refer to Scenario 12-3.Suppose the government levies

Q155: Refer to Figure 11-1.A ham sandwich is

Q166: Suppose that policymakers are doing cost-benefit analysis

Q202: Lump-sum taxes are equitable but not efficient.

Q263: Refer to Table 12-9.For this tax schedule,what

Q274: The average American pays a higher percent

Q278: Refer to Table 11-5.Suppose the cost to