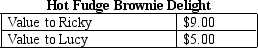

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Total consumer surplus

Definitions:

Pre-Tax Retirement Account

A savings account designed for retirement that allows individuals to contribute pre-tax income, with taxes deferred until withdrawal.

Compounded Monthly

The process of adding interest to the principal sum of a loan or deposit, where the interest is calculated on a monthly basis.

Early Withdrawal Penalty

A charge applied for taking money out of a financial account or investment before a set date or term has ended.

Spreadsheet

A digital document that uses rows and columns to organize data, calculations, and information, commonly used in accounting and financial analysis.

Q81: Refer to Scenario 13-10.An economist would calculate

Q157: A congested side street in your neighborhood

Q270: Which of the following contributes to the

Q303: Lump-sum taxes are rarely used in the

Q342: In the United States,the marginal tax rate

Q373: Refer to Table 12-7.What is the marginal

Q400: The three largest categories of spending by

Q413: The notion that similar taxpayers should pay

Q441: The concept of a "welfare program" is

Q450: Economists normally assume that the goal of