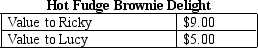

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Deadweight loss arises because

Definitions:

Annual Installments

Payments made yearly towards the settlement of a debt or purchase price over a fixed period.

Interest

Interest is the charge for borrowing money or the compensation paid to depositors, calculated as a percentage of the principal amount.

Compounded Monthly

A method of calculating interest in which the accrued interest is added to the principal at the end of each month, leading to interest on interest in subsequent months.

Mortgage

A loan provided by a lender or a bank that enables an individual to purchase a home or real estate, using the property itself as collateral.

Q49: To fully understand the progressivity of government

Q75: Refer to Table 12-7.What is the marginal

Q91: Corporate income taxes are based on the

Q119: If all taxpayers pay the same percentage

Q144: A person's tax liability refers to<br>A) the

Q174: Refer to Scenario 13-6.An economist would calculate

Q176: As with many public goods,determining the appropriate

Q222: Refer to Scenario 13-11.Zach's economic profit for

Q331: Under which of the following scenarios would

Q463: Refer to Figure 13-1.Suppose the production function