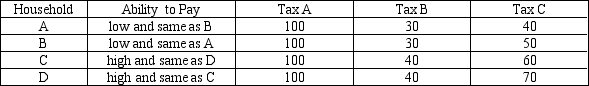

Table 12-16

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.

-Refer to Table 12-16.In this economy Tax B exhibits

Definitions:

Monetary Policy

Government or central bank policies aimed at controlling the supply of money and interest rates in an economy.

Fiscal Policy

A government's strategy for managing its budget, especially through taxation and spending decisions, to influence the economy.

Aggregate Demand

The entire market demand for goods and services within an economic environment, determined at an established price level over a fixed duration.

Stock Prices

The market price at which shares of a public company's stock are bought and sold.

Q61: Government agencies,such as the National Science Foundation,subsidize

Q99: When the marginal tax rate equals the

Q120: Suppose that the government taxes income in

Q151: One benefit of the patent system is

Q177: Refer to Scenario 13-15.Farmer Jack's marginal cost<br>(i)curve

Q321: The marginal product of labor is equal

Q374: Diminishing marginal product suggests that the marginal<br>A)

Q451: Refer to Scenario 13-3.If Gary can work

Q464: Sales taxes generate nearly 50% of the

Q494: Refer to Table 13-12.What is the total