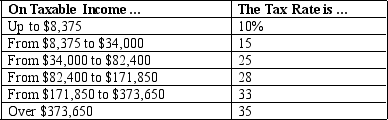

Table 12-1

-Refer to Table 12-1.If Agatha has $80,000 in taxable income,her tax liability is

Definitions:

Paid-in Capital

Paid-in capital is the amount of money that a company has received from shareholders in exchange for shares of stock, reflecting the capital that has been invested in the company beyond its par value.

Common Stock Subscribed

A commitment by investors to purchase shares of a company's common stock, where the shares are reserved for the subscribers until payment is made.

Dividends in Arrears

Dividends on preferred shares that have not been paid in the scheduled time, accruing until they are paid out.

Q12: An example of an explicit cost of

Q19: Market failure associated with the free-rider problem

Q139: The government provides public goods because<br>A) private

Q172: Ten friends who love to ski decide

Q255: Which of the following is a disadvantage

Q326: In 2009,social insurance taxes represented approximately what

Q348: When the total surplus lost as a

Q414: Deadweight losses occur in markets in which<br>A)

Q436: Implicit costs<br>A) do not require an outlay

Q477: If transfer payments are included when evaluating