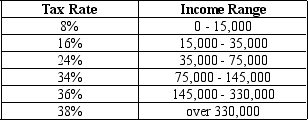

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Livi has taxable income of $78,000,her tax liability is

Definitions:

Visual Cliff

An experimental apparatus designed to test the depth perception and fear of heights in infants and young animals.

Crawling Experience

Refers to the phase in early child development where infants learn to move on their hands and knees, which is crucial for motor skills development.

Infants

Young babies, typically those under one year of age, who are in the very early stages of development.

Linear Perspective

A technique in art and photography that creates the illusion of depth on a flat surface by converging parallel lines towards a single point in the distance.

Q64: A study that compares the costs and

Q106: According to the Coase theorem,the private market

Q171: The enclosure movement in England in the

Q201: Some goods can be classified as either

Q241: Vertical equity states that taxpayers with a

Q243: Refer to Table 12-13.Which of the three

Q271: Suppose a certain good provides an external

Q282: The U.S.patent system<br>A) makes general knowledge excludable.<br>B)

Q301: When something of value has no price

Q332: An example of an opportunity cost that