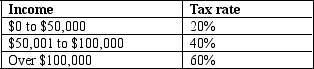

Table 12-7

-Refer to Table 12-7.What is the average tax rate for a person who makes $120,000?

Definitions:

Variable Costing

An accounting method that includes only variable production costs—such as materials, labor, and overhead—in the cost of goods sold, while fixed costs are expensed in the period they are incurred.

Fixed Overhead Cost

Costs that do not vary with production volume, such as rent, salaries, and insurance, and must be paid regardless of the level of output or sales.

Ending Inventory

The value of goods available for sale at the end of an accounting period, which will be carried over as the beginning inventory for the next period.

Variable Costing

An accounting method that only considers variable costs (costs that change with production volume) in the cost of production, excluding fixed costs.

Q60: Maurice faces a progressive federal income tax

Q86: David's firm experiences diminishing marginal product for

Q93: Total revenue equals<br>A) price x quantity.<br>B) price/quantity.<br>C)

Q145: The marginal product of labor can be

Q149: Refer to Scenario 13-6.Tony's accounting profit equals<br>A)

Q159: Markets fail to allocate resources efficiently when<br>A)

Q226: A tax system exhibits vertical equity when

Q267: If we can conclude that human life

Q288: Most goods in our economy are allocated

Q304: Which of the following statements is not