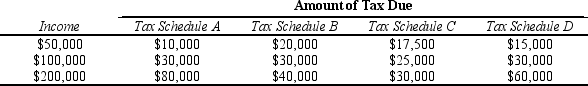

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the highest average tax rate?

Definitions:

Financial Strength

A company’s ability to maintain its financial health, typically measured through metrics like liquidity, solvency, and profitability indicators.

Long-term Investors

Individuals or entities that purchase assets with the intention of holding them for an extended period, typically expecting to benefit from long-term growth.

Underwriting Syndicate

A group of financial institutions that work together to issue and distribute a new security to the public.

IPO

Initial Public Offering, the process by which a private company becomes publicly traded by offering its shares for the first time to the public.

Q27: Each of the following explains why cost-benefit

Q53: The Tragedy of the Commons can be

Q84: Refer to Table 13-8.What is the shape

Q182: The Wacky Widget company has total fixed

Q195: Refer to Scenario 12-3.Suppose the government levies

Q247: Refer to Scenario 12-4.At what level of

Q283: Refer to Table 13-12.What is the marginal

Q291: The amount by which total cost rises

Q331: Refer to Scenario 12-1.Suppose the government levies

Q361: Which of the following is the best