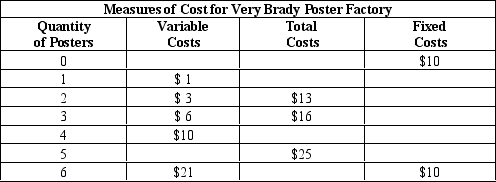

Table 13-9

-Refer to Table 13-9.What is the variable cost of producing 5 posters?

Definitions:

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities related to the production of goods or services.

Materials Handling

Activities involved in moving, storing, controlling, and protecting materials and products throughout the manufacturing, warehousing, distribution, consumption, and disposal processes.

Allocation Rate

A financial metric used to assign indirect costs to different projects or departments within an organization.

Total Overhead

The total of all indirect costs associated with the manufacturing process, including indirect labor, materials, and other expenses necessary for production.

Q66: A profit-maximizing firm in a competitive market

Q99: When the marginal tax rate equals the

Q124: Refer to Table 12-11.Which tax schedule could

Q179: Refer to Table 14-10.At which level of

Q220: Refer to Scenario 14-2.At Q = 999,the

Q242: Refer to Table 14-14.What is the marginal

Q283: Refer to Table 13-12.What is the marginal

Q286: Refer to Table 13-12.What is the variable

Q296: Suppose a profit-maximizing firm in a competitive

Q324: Free entry means that<br>A) the government pays