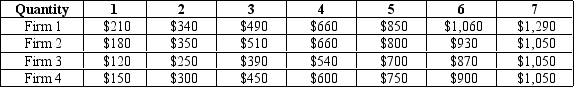

Table 13-15

Consider the following table of long-run total cost for four different firms:

-Refer to Table 13-13.Which firm has constant returns to scale over the entire range of output?

Definitions:

Year 2

The second year in a sequence, often used in financial and operational planning or analysis.

Debt-to-Equity Ratio

A measure of a company's financial leverage calculated by dividing its total liabilities by shareholders' equity; it indicates the proportion of equity and debt the company is using to finance its assets.

Year 2

A reference to the second year in a given context, typically used in financial forecasting or product development timelines.

Return On Total Assets

A financial metric that measures a company's earnings before interest and taxes (EBIT) relative to its total asset value.

Q72: Which of the following industries is most

Q134: Refer to Figure 13-7.Which of the figures

Q209: On a 100-acre farm,a farmer is able

Q211: The marginal-cost curve intersects the average-total-cost curve

Q249: Refer to Table 14-9.The maximum profit available

Q295: In the long run Firm A incurs

Q298: Susan quit her job as a teacher,which

Q308: Refer to Figure 14-6.When market price is

Q351: Suppose you bought a ticket to a

Q401: Refer to Table 13-10.What is the marginal