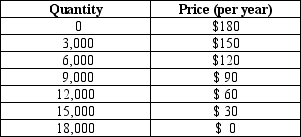

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

-Refer to Table 17-3.Assume there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell.What price will premium digital channel cable TV subscriptions be sold at when this market reaches a Nash equilibrium?

Definitions:

Factor

A factor refers to an element or condition that contributes to a result; in finance, it could also mean a firm that buys receivables from businesses.

Selling Expense

Costs related to the selling of products or services, including advertising, sales staff salaries, and commissions.

Interest Expense

The cost associated with an organization's debt over a given period of time.

Accounts Receivable

This represents the funds owed to a business by customers for goods or services delivered or used but not yet paid for.

Q16: In some games,the noncooperative equilibrium is bad

Q89: Refer to Table 17-3.Assume there are two

Q137: Refer to Table 16-4.Which of the following

Q157: Refer to Scenario 16-2.As a result of

Q206: Refer to Figure 16-3.Assume the firm in

Q236: Refer to Table 17-21.If John chooses Drive

Q318: Assuming that oligopolists do not have the

Q356: A manufacturer of light bulbs sells its

Q377: For a profit-maximizing,competitive firm,the value of the

Q392: Among the following situations,which one is least