Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

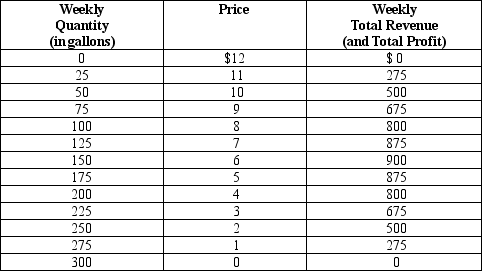

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

-Refer to Table 17-5.Suppose the town enacts new antitrust laws that prohibit Kunal and Naj from operating as a monopolist.What will quantity of water will each of them produce once the Nash equilibrium is reached?

Definitions:

Risk Free Asset

An investment that is expected to return its original value without any loss and with a certain rate of interest; considered to have zero default risk.

Rate of Return

The increase or decrease in the value of an investment during a set time frame, represented as a proportion of the investment's original price.

Level of Risk

The degree of uncertainty associated with an investment or decision, often regarding the potential for loss.

Optimal Portfolio

An investment strategy that maximizes expected return for a given level of risk through diversification.

Q90: Professional organizations and producer groups have an

Q167: A firm in a monopolistically competitive market

Q189: If firms in a monopolistically competitive market

Q288: Professional organizations (for example,the American Medical Association

Q299: Which of the following groups or entities

Q309: With respect to monopolistic competition,<br>A) both the

Q322: Refer to Figure 18-2.The marginal product of

Q328: Monopolistic competition and monopoly are examples of

Q350: To maximize its profit,a monopolistically competitive firm

Q402: Ford and General Motors are considering expanding