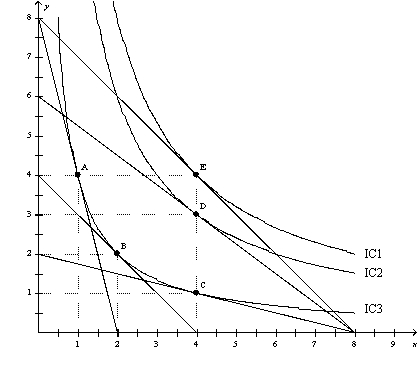

Figure 21-16

-Refer to Figure 21-16.When the price of X is $6,the price of Y is $24,and income is $48,Steve's optimal choice is point C.Then the price of Y decreases to $8.Steve's new optimal choice is point

Definitions:

Additional Assessment

Additional taxes levied by a taxing authority following an audit or amended tax return.

Miscellaneous Itemized Deductions

Various deductions that could be taken when calculating an individual's taxable income, subject to specific rules and limitations.

Gambling Losses

Financial losses resulting from wagering, which can be deducted up to the amount of gambling winnings on a taxpayer’s return.

Adjusted Gross Income

Gross income minus adjustments to income. This figure is used to determine how much of your income is taxable.

Q73: When one party is better informed about

Q101: When we derive the demand curve for

Q127: A disadvantage associated with a minimum wage

Q188: The percentage of families with incomes below

Q264: A family's ability to buy goods and

Q281: Refer to Figure 21-12.If the consumer moves

Q288: The Borda count fails to satisfy which

Q293: If a consumer purchases more of good

Q351: Suppose that residents of a town are

Q395: For a typical consumer,most indifference curves are