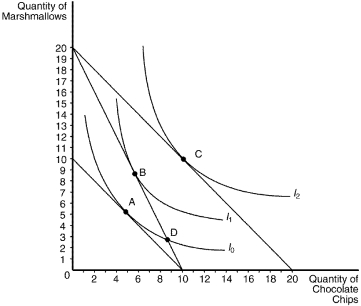

Figure 21-19 The Following Graph Illustrates a Representative Consumer's Preferences for Marshmallows

Figure 21-19

The following graph illustrates a representative consumer's preferences for marshmallows and chocolate chip cookies:

-Refer to Figure 21-19.Assume that the consumer has an income of $100 and currently optimizes at bundle A.When the price of marshmallows decreases to $5,which bundle will the optimizing consumer choose?

Definitions:

Required Return

The minimum expected return an investor demands for investing in a particular asset, considering the risk involved.

Correlation Coefficients

Statistical measures that indicate the extent to which two variables fluctuate together.

Risk-Free Rate

The rate of return on an investment with no risk of financial loss, often represented by the yield on government securities.

Market Risk Premium

The additional return an investor expects to receive from a market portfolio over a risk-free rate due to the inherent risks.

Q41: The Callaway family owns a small bait

Q103: Because people with hidden health problems are

Q132: Refer to Figure 21-10.Which of the following

Q175: Refer to Table 22-4.Which pairwise voting scheme

Q263: Refer to Scenario 22-5.Vinny recommends using a

Q296: A consumer consumes two normal goods,sandwiches and

Q300: Refer to Scenario 20-1.Assuming that utility is

Q371: Refer to Figure 21-6.Suppose a consumer has

Q415: Violations of the law of demand are

Q451: Angie is maximizing total utility while consuming