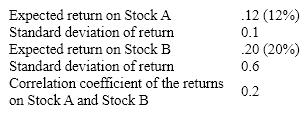

Given the following information:

a. What are the expected returns and standard deviations of the following portfolios?

1. 100 percent of funds invested in Stock A

2. 100 percent of funds invested in Stock B

3. 50 percent of funds invested in each stock?

b. What would be the impact if the correlation coefficient were -0.6 instead of 0.2?

Definitions:

Emotional Bond

A strong psychological connection between individuals, characterized by feelings of affection, loyalty, and attachment.

Mating Strategy

An approach or techniques used by individuals to find and attract a partner for reproduction and long-term bonding.

Evolutionary Psychology

A theoretical approach in psychology that examines psychological structure from a modern evolutionary perspective.

Multiple Sexual Partners

The practice or behavior of having sexual interactions with more than one individual, distinct from monogamous relationships.

Q12: The Pines, a small motel in central

Q15: The direct sale of new securities to

Q28: The objective of Sarbanes-Oxley was to create

Q31: EEM, INC has a $1,000,000 debt outstanding

Q39: Reinvestment rate risk refers to fluctuations in<br>A)a

Q40: An index fund limits its portfolio to<br>A)high

Q42: The more financially leveraged a firm, the

Q44: A "round lot" is the general unit

Q54: If financial markets are efficient, that suggests

Q69: A times-interest-earned of 0.9 means that interest