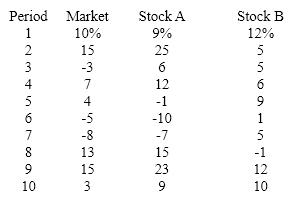

(This problem illustrates the computation of beta coefficients may be solved using a statistics program or Excel.)The returns on the market and stock A and stock B are as follows:

Compute the beta coefficient for each stock and interpret the results of the computations.

Definitions:

Revaluation Model

An accounting method that allows assets to be carried at a revalued amount, reflecting current values rather than historical cost, with adjustments made to the assets' carrying amount on the balance sheet.

Reversals of Revaluation

An accounting process that negates a previously recorded increase or decrease in the value of an asset to reflect its current market value.

Accumulated Depreciation

The total amount of depreciation expense recorded for an asset over its useful life, reducing its book value on the balance sheet.

Fully Depreciated

Fully Depreciated refers to an asset that has reached the end of its useful life, and its book value is equal to its salvage value in the financial records.

Q2: If an investor sells a stock short,

Q14: Mutual funds report their returns on a

Q15: The shares of load mutual fund sell

Q21: A put exists with the option to

Q32: The price of an option is generally

Q33: The doctrine of stare decisis<br>A)makes the legal

Q34: Put-call parity suggests that<br>A)the sum of the

Q37: The advantages offered by investment companies include<br>1.

Q38: Once securities are purchased, they are usually

Q39: Convertible preferred stock<br>1. pays a fixed dividend<br>2.