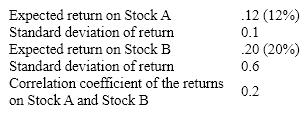

Given the following information:

a. What are the expected returns and standard deviations of the following portfolios?

1. 100 percent of funds invested in Stock A

2. 100 percent of funds invested in Stock B

3. 50 percent of funds invested in each stock?

b. What would be the impact if the correlation coefficient were -0.6 instead of 0.2?

Definitions:

Q2: Which of the following statements is most

Q5: According to the Black/Scholes option valuation model,

Q5: Creditors would prefer<br>1. a quick ratio of

Q11: If an investor constructs a covered call,<br>A)there

Q11: Society is hurt when business managers behave

Q13: In the House of Representatives, a state's

Q21: Preferred stock dividends are<br>1. a legal obligation<br>2.

Q31: What is the primary trial court in

Q40: Which of the following is a retirement

Q46: Entering a futures contract to sell corn