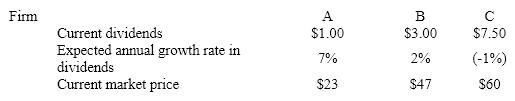

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have analyzed three risky firms and must decide which (if any)to purchase. Your information is

a. What is your valuation of each stock using the dividend-growth model? Which (if any)should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

Definitions:

Retirement Planning

The process of determining retirement income goals and the actions and decisions necessary to achieve those goals.

Withdraw

To remove funds from a bank account or to take back an offer or statement.

Annual Annuity

A fixed sum of money paid to someone each year, typically for the rest of their life or for a specified period.

Compounded Annually

Compounded annually refers to the process of earning interest on both the initial principal and the accumulated interest from previous periods, calculated once per year.

Q8: A subpoena duces tecum is different from

Q8: Since ETFs mimic an index, they do

Q18: The primary source of federal power to

Q21: Explain the core principles in the Fair

Q28: Explain the role that power, importance, and

Q40: Which of the following is not part

Q65: Edith becomes ill at work, but her

Q68: Don was driving his truck when a

Q80: Dewayne sold a space heater to Vivian,

Q100: Lower cash flow may be the result