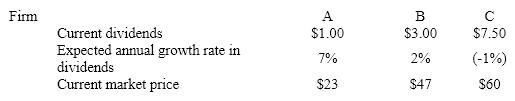

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have analyzed three risky firms and must decide which (if any)to purchase. Your information is

a. What is your valuation of each stock using the dividend-growth model? Which (if any)should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

Definitions:

Unit Sales

The volume of product sold, representing a key measure of a company's performance and sales activity.

Variable Expense

Expenses that change in proportion to the amount of goods produced or the volume of sales, like materials or commissions on sales.

Selling Price

The amount of money for which a product or service is sold to customers, setting the revenue baseline for a business.

Contribution Margin

The difference between sales revenue and variable costs, indicating how much revenue contributes to covering fixed costs and profit.

Q1: The concept of stare decisis is closely

Q7: The primary role of organized securities exchanges

Q12: If the quote on stock is reduced,

Q14: A government action interfering with a fundamental

Q15: A low price to sales ratio suggests<br>A)the

Q16: Emily, an 11-year-old girl, wants to sign-up

Q24: Wayne worked in an office. He had

Q32: Diversification reduces reinvestment rate risk.

Q47: If a stock is quoted 12.79-13.02, an

Q51: Don was standing in a cafeteria line