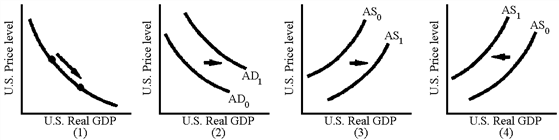

Figure 36-5

Which of the graphs in Figure 36-5 are consistent with a depreciation of the U.S. dollar and an increase in net exports caused by a decrease in U.S. interest rates?

Definitions:

Default Risk Premiums

The extra yield that an investor demands to compensate for the risk that the issuer of a bond may default on payment.

Treasury Bond

U.S. government debt instruments featuring fixed interest rates and long-term maturity periods exceeding ten years.

Subprime Mortgages

Loans granted to borrowers with poor credit histories, which carry higher interest rates than standard mortgages to compensate for the higher risk.

Mortgage-backed CDOs

Complex structured finance products that pool together cash flow-generating assets and repackages this asset pool into tranches that can be sold to investors, specifically focusing on mortgage-backed securities.

Q26: One of the results of the strong

Q44: Economic theory shows that the current account

Q58: The effect of an import quota is

Q101: Between 1981 and 1986, as the federal

Q106: If the dollar depreciates relative to other

Q112: Under floating exchange rates, investors who speculate

Q149: An example of a quota that protects

Q165: An economic boom in the United States

Q199: Table 36-1 Suppose the economy of Macroland

Q204: Figure 34-7<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9029/.jpg" alt="Figure 34-7