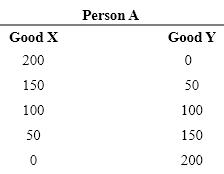

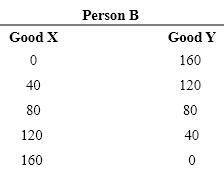

Exhibit 2-10

Refer Exhibit 2-10. Person A has the comparative advantage in the production of _____________ and person B has the comparative advantage in the production of __________________.

Refer Exhibit 2-10. Person A has the comparative advantage in the production of _____________ and person B has the comparative advantage in the production of __________________.

Definitions:

LIFO

"Last In, First Out," an inventory valuation method where the most recently produced or purchased items are recorded as sold first, affecting cost of goods sold and inventory value.

FIFO Inventory Method

An accounting method for valuing inventory that assumes the first items purchased are the first to be sold.

Cost Of Goods Sold

The total cost directly associated with producing goods that have been sold, including materials and labor.

Days' Sales

Often part of larger financial metrics, this term by itself is unclear without additional context such as Days' Sales Outstanding (DSO).

Q2: The Office Mix screen recording view lacks

Q6: The area at the top of the

Q24: A(n)_ is a small arrow or other

Q47: What is the typical drive letter for

Q68: If there is typically bumper-to-bumper traffic on

Q74: A subsidy placed on the consumption of

Q135: Consider two straight-line PPFs. They have the

Q158: A vertical supply curve represents:<br>A)an inverse relationship

Q187: It is very important for the seller

Q215: If the demand for a good increases