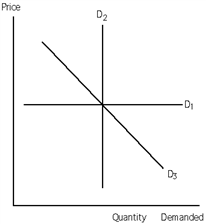

Exhibit 19-1

Refer to Exhibit 19-l. The demand for the good represented by demand curve D2 is

Definitions:

Capital Structure

Capital structure refers to the mix of a company's long-term debt, specific short-term debt, common equity, and preferred equity, which is considered when financing its overall operations and growth.

Bankruptcy Risk

Bankruptcy risk refers to the likelihood that a company will be unable to meet its debt obligations and may be forced into bankruptcy.

Agency Costs

Expenses arising from the conflict of interest between a company's management or its shareholders and its creditors.

Financial Risk

The risk added by the use of debt financing. Debt financing increases the variability of earnings before taxes (but after interest); thus, along with business risk, it contributes to the uncertainty of net income and earnings per share. Business risk plus financial risk equals total corporate risk.

Q4: Exhibit 4-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 4-1

Q27: Exhibit 19-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 19-3

Q29: Suppose that a consumer purchases a combination

Q45: It is impossible for a given good

Q58: Exhibit 20-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 20-3

Q59: Exhibit 4-10 <br><br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 4-10

Q94: Marginal utility analysis can be used to

Q96: Exhibit 4-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 4-3

Q137: If the average variable cost curve is

Q163: If income elasticity of demand is 2.12,