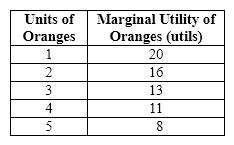

Exhibit 20-2  Refer to Exhibit 20-2. Total utility for the first two oranges is

Refer to Exhibit 20-2. Total utility for the first two oranges is

Definitions:

Tax Payments

Tax Payments are the compulsory financial charges or levies paid to the government by individuals, businesses, or other legal entities to fund public expenditures.

Non-operating Income

Non-operating Income is the income earned from non-core business activities, including one-time events or earnings from investments, that does not derive from the company's primary business operations.

Operating Income

Operating income is the amount of profit realized from a business's core operations, excluding taxes and interest expenses.

Negative Net Cash Flow

A situation where a company's outgoing cash exceeds the incoming cash during a specific period, indicating potential financial trouble.

Q6: Exhibit 5-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 5-1

Q8: Accounting profit equals economic profit if _

Q63: Which of the following statements does not

Q78: Firm X is producing the quantity of

Q87: Exhibit 19-5 <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 19-5

Q94: Exhibit 4-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 4-3

Q120: As the marginal physical product of a

Q161: The diamond-water paradox is illustrated by which

Q198: Suppose at a price of $4 and

Q233: John purchases a baseball card for $10