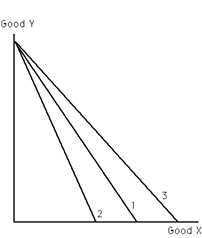

Exhibit 20-8

Refer to Exhibit 20-8. A move of the budget constraint from 2 to 3 is caused by a

Definitions:

Corporate Tax

A tax imposed on the income or profit of corporations and businesses by the government.

Individual Income Tax

A tax imposed by federal, state, and/or local governments on the income earned by individuals.

Earnings and Profits

A measure of a company's ability to generate income over its expenses, often used in corporate taxation.

Capital Gain

The profit from the sale of a capital asset, such as stocks, bonds, or real estate, exceeding the purchase price.

Q2: Which of the following would result in

Q16: In perfect competition, the firm's marginal revenue

Q54: The law of diminishing marginal utility helps

Q55: In the short run, if price (P)is

Q81: One of the assumptions of the theory

Q85: In the theory of perfect competition,<br>A)sellers of

Q122: Exhibit 21-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 21-14

Q183: If for good Z income elasticity is

Q190: Which of the following statements is true?<br>A)Costs

Q203: _ scale exist when inputs are increased