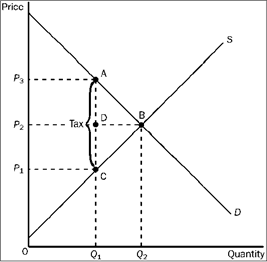

Figure 4-24

Refer to Figure 4-24. The amount of the tax on each unit of the good is

Definitions:

Primary Tax Authority

The most authoritative sources of tax law, including statutes, regulations, and court decisions, which are used to find the legal basis for tax positions.

Statutory

Relating to laws or statutes, often used in the context of rights or obligations that are legally defined.

Judicial

Pertaining to the courts or to the administration of justice.

Tax Liability

The sum of money owed to a tax agency based on earned income, investments, property, and other taxable entities.

Q15: Of all government spending in the United

Q28: Which of the following would be a

Q32: When a shortage of a good is

Q38: Figure 5-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 5-1

Q99: If a federal agency requested funds to

Q136: Other things constant, if both the benefits

Q173: Deadweight losses are associated with<br>A) taxes that

Q213: If a $300 subsidy is legally (statutorily)

Q287: Use the figure below to answer the

Q496: Figure 3-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 3-20