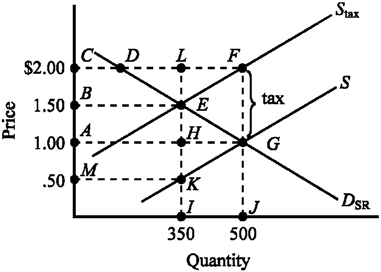

Use the figure below illustrating the impact of an excise tax to answer the following question(s) .

Figure 4-6

Refer to Figure 4-6. The amount of the actual tax burden paid by consumers and producers is

Definitions:

Producing Departments

Sections within a manufacturing facility where raw materials are processed or assembled into finished products.

Fixed Costs

Costs that do not change with the level of output or sales, such as rent, salaries, and insurance premiums.

Cafeteria

A type of food service location within an establishment where customers serve themselves from a variety of options.

Transfer Prices

Prices charged in the sale or transfer of goods and services between departments or divisions within the same company, often used for accounting or tax purposes.

Q15: If Heather's tax liability increases from $10,000

Q54: In a market that lacks sufficient competition,<br>A)

Q76: What are the two distinguishing characteristics of

Q97: A special-interest issue is one that<br>A) allocates

Q138: An increase in the number of students

Q172: The Laffer Curve indicates that<br>A) when tax

Q304: When the top marginal tax rates were

Q305: Figure 3-4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 3-4

Q347: Figure 3-15 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 3-15

Q513: If the supply of a good decreased,