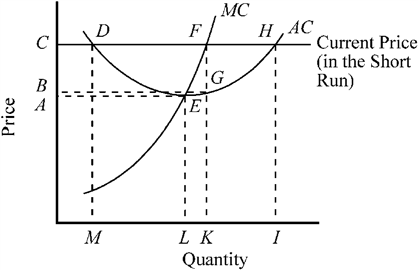

Use the figure to answer the following question(s) .

Figure 9-11

If the current market price for the firm depicted in Figure 9-11 is A , given the firm's cost conditions, which output should it produce?

Definitions:

Capital Gains

The profit from the sale of a capital asset, such as stocks or real estate, over its purchase price.

Residual Dividend Policy

A strategy for setting dividend payments based on the firm's residual or leftover equity after funding all its investment projects.

Debt-Equity Ratio

A financial ratio that shows the relative amounts of shareholders' equity and debt financing used to fund a company's assets.

Capital Projects

Large-scale investments undertaken by a firm to maintain or expand its business operations.

Q25: Figure 10-12 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 10-12

Q87: A price-taker firm is currently producing 50

Q106: The practice of price discrimination has which

Q150: There are 1,000 identical firms in a

Q191: The costs of a firm indicate the

Q202: When we say that a firm is

Q212: If a government wanted to increase the

Q245: A price-taker market tends toward a state

Q366: In the long run, in a price-taker

Q482: If a competitive price-taker firm is currently