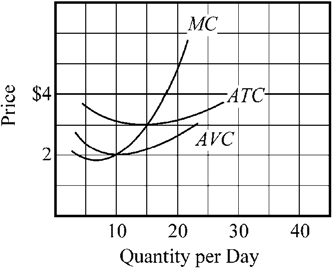

Use the figure to answer the following question(s) .

Figure 9-8

If the market price in Figure 9-8 increases to $4, indicate the firm's profit-maximizing output and total revenue.

Definitions:

NPV

Net Present Value, a calculation used to determine the value of an investment by discounting future cash flows to their present value.

Payback Analysis

A financial analysis method used to determine the time required to recoup the cost of an investment or project.

NPV

An evaluation method used to assess the profitability of an investment by calculating the difference between its current cash inflows and outflows, discounted to their present values.

IRR

Internal Rate of Return represents a financial measure for assessing the potential profitability of investments.

Q22: Use the figure to answer the following

Q50: Use the figure to answer the following

Q85: When a law is passed that requires

Q106: Use the figure to answer the following

Q110: Which of the following will reduce the

Q130: Which of the following variables is left

Q163: Which of the following conditions is most

Q267: In a price-taker market, profits are<br>A) the

Q305: If a product is manufactured under conditions

Q346: When a firm in a price-taker industry