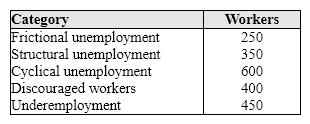

Exhibit 6-3 Unemployment categories

According to data in Exhibit 6-3 and assuming the total number of workers is 8,400, the unemployment rate is:

Definitions:

FICA

Refers to the Federal Insurance Contributions Act taxes, which are payroll taxes paid by both employees and employers to fund Social Security and Medicare.

Overtime Earnings

Compensation received for hours worked in excess of the standard workweek hours, often calculated at a rate higher than the regular hourly rate.

Liability Accounts

Accounts on a balance sheet that represent what a company owes to others, such as loans, accounts payable, mortgages, deferred revenues, and accrued expenses.

Expense Accounts

These accounts are used in accounting to track the consumption of assets or services that contribute to the operation and revenue generation of the business.

Q10: Which of the following is a distinction

Q26: A rightward shift in the aggregate demand

Q29: Dividends, retained earnings, and corporate income taxes

Q40: Exhibit 16-2 Unemployment categories<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8793/.jpg" alt="Exhibit 16-2

Q53: Within the framework of the Keynesian Cross

Q54: Exhibit 13-3 A monopolist<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8793/.jpg" alt="Exhibit 13-3

Q58: Exhibit 9-6 Keynesian aggregate expenditure model when

Q82: Which of the following is not a

Q85: Full employment is the situation in which

Q90: Exhibit 10-4 Aggregate supply and demand curves<br><img