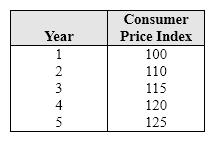

Exhibit 7-1 Consumer Price Index

As shown in Exhibit 7-1, the rate of inflation for Year 2 is:

Definitions:

SML

Stands for Security Market Line; it represents the relationship between the expected return of an investment and its risk in the capital asset pricing model (CAPM).

Beta of the Portfolio

An assessment of a portfolio's volatility or inherent risk, relative to the overall market.

Required Return

The minimum annual percentage earned by an investment that will entice individuals or companies to put their money into it.

Risk-free Rate

The return on an investment with zero risk; typically represented by the yield on government bonds.

Q12: Suppose the government of a small island

Q26: A negative income tax system would provide

Q28: Since 1929, total government taxes as a

Q32: Within the Keynesian aggregate expenditures model, which

Q37: Losers from inflation include:<br>A) those on a

Q53: If the marginal propensity to consume (MPC)

Q54: Which of the following are not counted

Q58: The primary cause of frictional unemployment is:<br>A)

Q77: Given the same marginal revenue product (MRP)

Q105: Given full-employment output = $2,800, equilibrium real