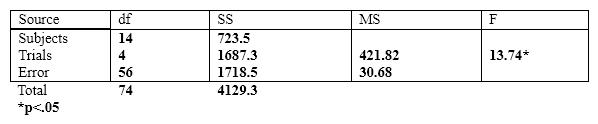

The next few questions are based on the following summary table.

If we compared Time 1 (baseline) against the next time (Time 2) and then against the last time (follow-up) , we would run the Bonferroni at

Definitions:

Present Value Factors

The numerical values used to calculate the present value of future cash flows, based on a specific discount rate.

Desired Rate of Return

The minimum rate of return on an investment that an investor considers acceptable, given its risk and alternative options.

Present Value Index

A ratio used to evaluate the relative profitability of an investment or project by comparing the present value of cash inflows to the present value of cash outflows.

Interest

The charge for borrowing money, typically expressed as an annual percentage rate, or the income earned from lending funds.

Q9: Multicollinearity occurs when the predictor variables are

Q9: The following is part of the printout

Q25: In distribution-free tests, you usually reject the

Q27: In the analysis of variance we will

Q36: A sampling distribution of the mean is

Q42: When deciding which statistical procedure to use,

Q45: Many textbooks (though not this one) advocate

Q47: If we know that a regression coefficient

Q48: If you have a number of scores

Q62: As you increase the number of observations