Case 1-3

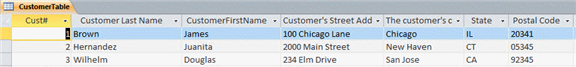

Main Street Catering has created a database with one table containing customer information. When creating the table, Marissa did not follow recommendations for naming fields in a table. There are a number of changes that would make the field names more useful and follow field naming recommendations. Using the accompanying figure, answer the following questions about the CustomerTable.Complete field names for all fields are not visible in the table. Which Access feature can Marissa use to make the entire field name visible while entering data?

Definitions:

Wage Bracket Withholding Table

A chart used by employers to determine the amount of tax to withhold from an employee’s paycheck based on their earnings and tax bracket.

Federal Income Taxes

Taxes levied by the government on the income earned by individuals, corporations, trusts, and other legal entities.

Merit Rating

A system used to evaluate the performance of employees by systematically rating them on their abilities and achievements within the organization.

State Unemployment Taxes

Taxes paid by employers to fund the state unemployment compensation programs for laid-off workers.

Q6: Case-Based Critical Thinking Questions Case 4-2<br>Carmen and

Q16: When you make a mistake in Paint,

Q20: A control that allows users to type

Q44: Which of the following is an example

Q56: A single characteristic or attribute of a

Q58: Each Access database may be as large

Q60: Windows 10 provides four different tools for

Q64: External devices are connected to your computer

Q75: Which view must be used to delete

Q95: The condition "Seattle" for the field City