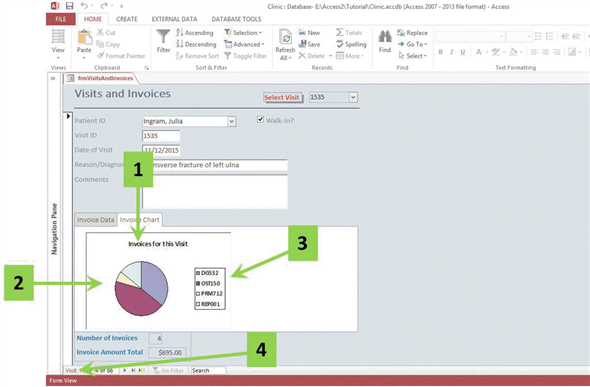

In the accompanying figure, which numbered arrow indicates the chart legend?

In the accompanying figure, which numbered arrow indicates the chart legend?

Definitions:

Income Tax Expense

The total amount of income tax a company owes to the government for a specified period, reflected in its financial statements.

Deferred Tax Liability

A tax obligation that a company will have to pay in the future, arising out of current transactions that are recognized in the financial statements before they are taxable.

Tax Rate Change

An adjustment in the percentage at which an individual or corporation is taxed, affecting the computation of tax liabilities and net income.

Temporary Difference

A difference between the book value and tax value of an asset or liability that will result in taxable or deductible amounts in future years.

Q2: A form created from related tables usually

Q15: An Access database may be saved as

Q55: Alignment of text in a field value

Q61: Field values related to records that contain

Q70: A _ query uses functions, such as

Q81: Case Based Critical Thinking Questions Case 8-1<br>The

Q87: Edit is the default setting for the

Q89: Values in a selected column may be

Q93: A(n) _ assigns the value of an

Q167: A specialized template which may contain tables,