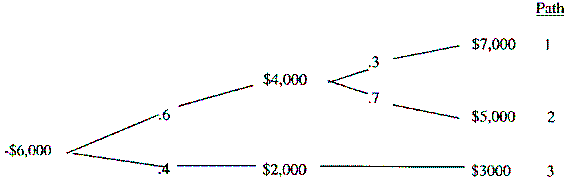

Reading Inc. is contemplating a project represented by the following decision tree. ($000).

Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

Definitions:

Consolidated Common Stock

Represents the aggregation of common stock of a parent company and its subsidiaries, shown in the consolidated financial statements.

Acquisition Transaction

An acquisition transaction involves one company purchasing most or all of another company's shares to gain control of that company.

Common Stock

A type of equity security that represents ownership in a corporation, entitling the holder to a share of the company's profits through dividends and/or capital appreciation.

Par Value

A nominal value assigned to share certificates of a company, which has no impact on market value but may affect legal capital.

Q27: A company is a portfolio of projects.

Q37: Financing costs such as interest costs should

Q38: How can a value be assigned to

Q103: Which of the following is true of

Q104: Business projects virtually always involve:<br>A)capital budgets.<br>B)early cash

Q113: The Accounting Rate of Return (ARR)calculates a

Q127: Taxes are important in capital investment evaluation

Q144: If a firm caters to a set

Q161: A project has an IRR of 16%

Q199: Two years ago our company bought equipment