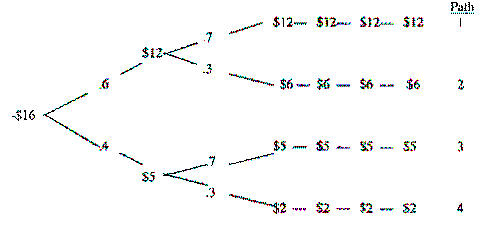

Kanick Corp is evaluating a new venture project and has developed the following decision tree analysis ($M).

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Definitions:

Strike Price

The fixed price at which an option's holder has the right to purchase (if a call option) or sell (if a put option) the underlying asset or commodity.

Option Premium

An option premium is the price that a buyer pays to the seller for an options contract, which gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified strike price.

Conversion Price

The predetermined price at which convertible securities can be exchanged for common stock.

Convertible Bond

A type of bond that can be converted into a predetermined number of the issuing company's shares at certain times during its life, usually at the discretion of the bondholder.

Q3: Explain the certainty equivalent approach.

Q18: In theory, the risk-free rate is more

Q40: The drawback in the replacement chain method,

Q64: The following information is available concerning a

Q71: Estimating inaccuracies in the capital budgeting process

Q115: Which of the following is a reason

Q115: If a company sells 10,000 units at

Q138: Use the dividend growth or Gordon model

Q148: The objective in solving capital rationing problems

Q154: Calculate the cost of preferred stock for