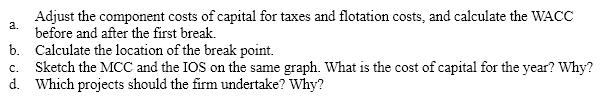

The following information pertains to the capital program of a firm:

Target capital structure : 30% debt, 20% preferred stock, 50% equity.

Unadjusted component costs of capital kd = 10%

kp = 12%

ke = 14%

Flotation Costs, Taxes, and Retained Earnings Flotation costs are 8% on common and preferred stock and zero on debt

The total effective tax rate (federal and state)is 40%

Retained earnings of $1,250,000 are expected next year.

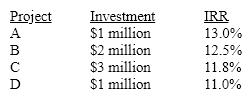

Investment Opportunities

Definitions:

Exercise Stress Test

A diagnostic test used to evaluate the heart's response to physical exertion, often involving walking or running on a treadmill, to detect cardiovascular problems.

Muscular Strength

The maximum amount of force that a muscle or group of muscles can exert in a single effort.

Aerobic Exercise

Physical activity that involves the use of oxygen to meet energy demands during exercise via aerobic metabolism.

Intensity

The degree of strength, power, or force of something, often used in contexts such as physical activity, emotional experiences, or phenomena.

Q18: In theory, the risk-free rate is more

Q52: Capital budgeting results are no more accurate

Q54: Commercial paper:<br>A)is normally issued by smaller firms

Q70: The board of Oschmann Enterprises declared a

Q85: Companies may choose to repurchase stock rather

Q90: Only project cash flows that are incremental

Q92: A company's cost of capital can be

Q108: Financial markets react when a firm pays

Q137: The clientele effect argues that only firms

Q153: The following information is available concerning a