The following information pertains to the capital program of a firm:

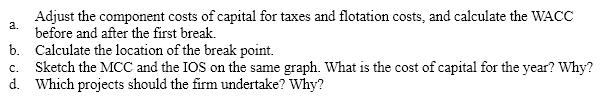

Target capital structure : 30% debt, 20% preferred stock, 50% equity.

Unadjusted component costs of capital kd = 10%

kp = 12%

ke = 14%

Flotation Costs, Taxes, and Retained Earnings Flotation costs are 8% on common and preferred stock and zero on debt

The total effective tax rate (federal and state)is 40%

Retained earnings of $1,250,000 are expected next year.

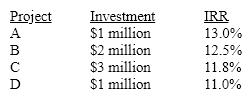

Investment Opportunities

Definitions:

Corporate Social Action

Activities undertaken by businesses to further social goods beyond the interests of the company and that which is required by law.

Government Intervention

Actions taken by a government to affect or interfere with decisions made by individuals or organizations in order to correct market failures or achieve social goals.

Classical Economic Model

A framework in economics that emphasizes free markets, competition, and the minimal role of government intervention in the economy.

Corporate Social Responsibility Model

A strategic framework for companies to voluntarily incorporate social and environmental concerns into their business operations and interactions with stakeholders.

Q2: Which of the following best describes the

Q55: Muller, Inc., manufacturer of cardboard boxes, is

Q57: Firms prefer not paying _if it avoids

Q81: The Gallagher Company has $1 million in

Q91: Traditional reasons for holding cash DO NOT

Q121: Hatter Inc. has the following capital components

Q147: In the context of working capital an

Q172: Decreases in working capital have to be

Q177: Variability in a firm's EPS reflects both

Q237: Working capital policy involves a tradeoff between