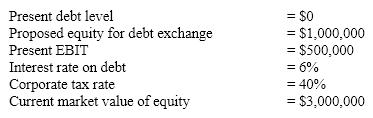

Assume the following selected financial information about a firm that is about to restructure capital by exchanging equity for debt:  What is the market value of the firm's equity after the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

What is the market value of the firm's equity after the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

Definitions:

Coupon Payment

The annual interest payment made to bondholders, typically expressed as a percentage of the face value.

Interest Rate Index

A benchmark interest rate that serves as a reference point for determining interest rates on various financial instruments or loans.

Coupon Rate

The yearly interest rate that a bond yields, represented as a percentage of its nominal value.

Face Value

The nominal or dollar value printed on a bond or stock certificate, representing the amount due at maturity or the value of a share.

Q3: The procedure to determine the after-tax cost

Q54: The capital Asset Pricing Model (CAPM)is one

Q57: The relevance of a sunk cost to

Q62: A(n)_ is a graphic representation of a

Q70: Riordan Manufacturing Company is considering replacing a

Q76: The Framer Corporation has been doing poorly

Q106: Which of the following are realistic motives

Q175: If a bank lends at 10% but

Q203: Banks like to make self-liquidating loans because

Q211: If a firm only accepts cash for