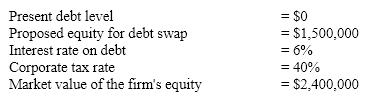

Assume the following selected financial information about a firm that is about to restructure capital by exchanging equity for debt:

a. If the firm operates in the world of the Modigliani-Miller model with taxes but without bankruptcy costs what would be the market value of its equity after the restructuring?

a. If the firm operates in the world of the Modigliani-Miller model with taxes but without bankruptcy costs what would be the market value of its equity after the restructuring?

b. By how much would the firm's total value and therefore shareholder wealth increase as a result of the swap? Explain.

c. Would we be able to answer the questions in part a and b precisely in the MM model with taxes and bankruptcy costs? Why?

Definitions:

Q53: Terminal values tend to be a big

Q78: A combination of companies that compete directly

Q84: In dividend reinvestment plans, stockholders receive additional

Q109: Which of the following is true of

Q123: Retained earnings are:<br>A)the only internally generated capital

Q130: We say a working capital financing policy

Q147: The ROCE measures the profitability of operations

Q155: A firm's degree of financial leverage is

Q161: Which of the following would not be

Q176: Firms are required to commit capital to