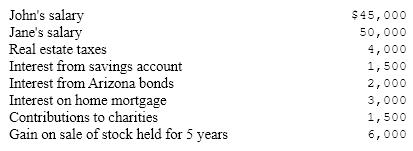

The following is a listing of tax considerations for John and Jane Alexander, who file jointly and have two children.

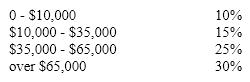

Assume the following hypothetical tax table:

Assume the following hypothetical tax table:

The personal exemption rate is $3,050

The personal exemption rate is $3,050

The long-term capital gains rate for this family is 18%.

a. How much is the Alexanders' taxable income?

b. What is the tax on their ordinary income?

c. What is their capital gains tax?

d. What is their overall average tax rate including the tax on capital gains?

e. What is their marginal tax rate on ordinary income?

Definitions:

Restrain Trade

Involves activities or agreements that restrict or limit competition within a market, often considered illegal under antitrust laws.

Antitrust Violations

Illegal activities under antitrust laws that lead to unfair competition, such as price fixing, monopolies, and other practices that significantly reduce market competition.

Sherman Act

A foundational piece of antitrust legislation in the United States, aimed at preventing monopolies and promoting competition.

Eastman Kodak

A technology company primarily known for its photographic film products, historically significant in the photography industry.

Q10: Firms typically invest in real assets such

Q10: The indirect quote for British pounds is

Q17: A common size income statement presents each

Q29: When must a vendor be paid in

Q35: In firms of moderate size or larger,

Q105: Uncollected receivables are normally:<br>A)depreciated.<br>B)expensed.<br>C)not reported.<br>D)written off.

Q127: _ is a growing practice in which

Q148: The corporate tax schedule seems not to

Q153: Which of the following actions by a

Q169: Spot rates imply delivery of the foreign