Baxter Inc. is in a fast growing industry, but doesn't seem to be able to match its competitors' growth rates. Selected financial information for Baxter is as follows ($000):

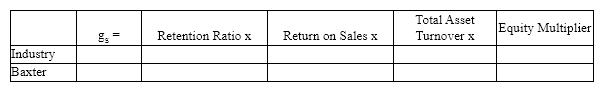

Research has revealed that the average firm in Baxter's industry pays out 10% of its earnings in dividends, earns 4 cents after tax on every sales dollar, has an equity multiplier of 3.0 and a total asset turnover of 1.9.

Research has revealed that the average firm in Baxter's industry pays out 10% of its earnings in dividends, earns 4 cents after tax on every sales dollar, has an equity multiplier of 3.0 and a total asset turnover of 1.9.

a. Use a sustainable growth rate analysis in the following table to determine the source(s)of Baxter's growth problems.

b. What negatives might be associated with fixing the problems revealed by the analysis?

b. What negatives might be associated with fixing the problems revealed by the analysis?

Definitions:

Beliefs

Convictions or acceptance that certain things are true or real, often without empirical evidence.

Attitudes

Mental and emotional entities that predispose an individual to respond to other people, objects, or institutions in a positive or negative way.

Dislikes

Feelings of aversion or distaste towards certain objects, individuals, or situations.

Personality

A set of enduring behavioral characteristics and internal predispositions for reacting to your environment.

Q9: Which of the following is an example

Q9: The Securities and Exchange Commission (SEC)supervises the

Q42: During the last year Alpha Co had

Q44: A portfolio is a collection of securities.

Q44: Ratio analysis is of significant value in

Q61: Exxon Corp. bought an oil rig exactly

Q143: Holding all other variables constant, an increase

Q155: You estimate that you will owe $70,000

Q157: There are just two stock exchanges in

Q207: A privately held, or closely held, company