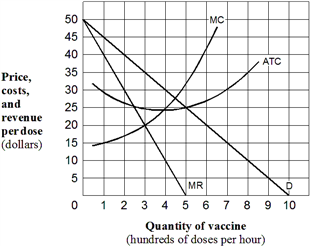

Exhibit 8-3 Demand and cost curves for GeneTech, a monopolist with a patented vaccine  In Exhibit 8-3, how much vaccine should GeneTech produce to maximize its profit?

In Exhibit 8-3, how much vaccine should GeneTech produce to maximize its profit?

Definitions:

Underlying Asset

The financial asset upon which derivative instruments, such as futures, options, or warrants, are based or derived from.

European Call Option

A financial contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a set price on a specific expiration date, only exercisable at the end of its term.

Expiration Date

The specific date upon which an options or futures contract becomes void and the holder must execute or relinquish the contract.

Exercise Price

The specified price at which the holder of an option can buy (call) or sell (put) the underlying asset.

Q8: Exhibit 6-16 Long-run average cost curves <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9287/.jpg"

Q8: Which of the following are not counted

Q50: A monopoly will price its product:<br>A) where

Q68: Exhibit 7-12 Marginal revenue and cost per unit

Q118: A market situation where a small number

Q132: Marginal revenue equals zero at which point

Q173: Exhibit 7-8 A firm's cost and marginal revenue

Q182: Wage discrimination means workers with equal productivity

Q239: For a typical firm, the long-run average

Q254: Diseconomies of scale cause the short-run marginal