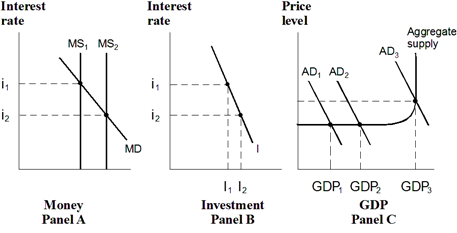

Exhibit 20-6 Money, investment and product markets  In Exhibit 20-6, if the Fed believes the economy is at AD3, how might it engineer a decline in the price level?

In Exhibit 20-6, if the Fed believes the economy is at AD3, how might it engineer a decline in the price level?

Definitions:

Secondary Mortgage Market

A market in which mortgages originated by a lender are sold to another financial institution. In recent years, the major buyers in this market have been Fannie Mae, Freddie Mac, and large investment banks.

Lending Standards

The criteria and guidelines used by financial institutions to determine the creditworthiness of prospective borrowers and to make decisions about loan applications.

Housing Prices

The amount of money required to buy homes in a particular area, which can fluctuate based on demand, location, and economic conditions.

Housing Bust

A rapid and significant decline in the housing market, characterized by falling home prices and increased foreclosures.

Q58: Exchange rates are for currency what:<br>A) c,

Q79: Starting from equilibrium in the money market,

Q99: The largest component of the M1 definition

Q99: According to the infant industry argument, a

Q102: Classical economists believe that an increase in

Q119: Reserve of banks appears on their balance

Q160: If the money supply increases this will

Q161: A tariff can be defined as a:<br>A)

Q164: Which type of demand for money causes

Q249: Tariff rates on products imported into the